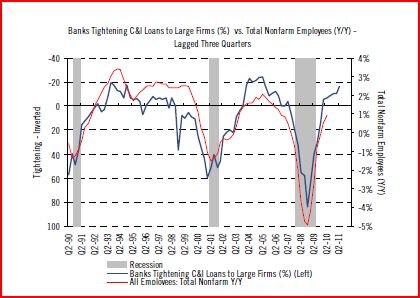

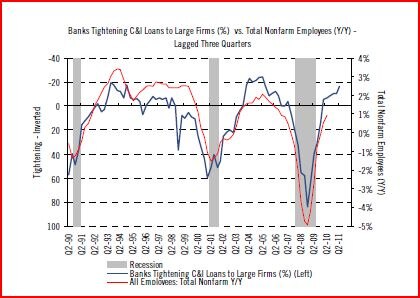

Chart of the month: Credit climate keeps improving.

Credit conditions, which are critical for business investment and economic activity, continue to move in a positive direction. The latest senior loan officers survey released by the Federal Reserve Board shows further easing in loan standards, including those for small business and consumers, during 2Q11. (See figure below.) The standards survey has been a powerful nine-month lead indicator for investments in human, physical and working capital. As credit conditions improve, it is highly likely that business trends and GDP should remain constructive for the balance of 2011, reducing the probability of economic weakness developing. Still, actual commercial and industrial loan activity lags the survey by 18 months, and investors need to understand the differences in timing.

Source: Haver Analytics and CIRA-US Equity Strategy, May 2011

Source: Haver Analytics and CIRA-US Equity Strategy, May 2011

While the investment community may get distracted by the end of the Fed's $600 billion in bond purchases this June, not to mention plausible softening in Institute for Supply Management (ISM) new order figures from current elevated levels, the cost of corporate capital is far more crucial for determining capital spending programs as the return of investment capital is weighted against its cost. Indeed, worries with respect to higher gasoline prices undermining consumption should be offset by more jobs as a result of the eased lending standards. Thus, as the credit environment progresses more favorably, so should the decision-making to generate returns.

Capital investment intentions also augur well for 2011 and support the cost-of-capital thesis. A study of more than 700 nonfinancial companies covered by Citi equity research analysts show a better than 11% gain in capital expenditures this year, a near doubling from the less than 6% increase in 2010, providing evidence that the changes in capital costs have meaningful impact. Accordingly, the credit backdrop should prevent a bear market development for stocks, barring exogenous shocks, though a summer pullback still seems to be in the offing.

NOTE: This post is adapted from Citi North America Equity Strategy's "May 2011 Chart of the Month," published on May 3, 2011.