Equity Strategy: The November 2011 Chart of the Month

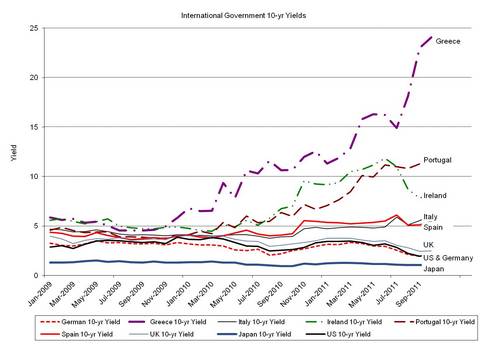

This month, Citi's Economic Surprise Index shows a clear divergence between the US and Europe. Investors have clearly been buffeted by swings in the news (or, possibly, noise) flow from Europe, with political leaders and their fates intertwining with both equity and bond market movement. Yet, it is crucial to understand that credit differences between the two continents will ultimately bite into real business demand.

The US has also benefited from some better economic news while Europe has suffered a less fortunate fate. Better new orders in the US ISM index and slightly stronger-than-expected GDP, as well as some modest job growth and improved jobless claims, all have contributed to a sense of relief that America is not double dipping. We had stressed for a good while that the current US credit environment was far better than that seen in 2007-08.

Fortunately, when the credit backdrop does not implode -- as it did in 2008 -- industrial activity can expand. With a close (nine-month lagged) relationship between credit conditions, earnings and industrial production, the lack of major borrowing cost increases is very supportive for the S&P 500 EPS trend, in our view. While there are fears that margins have to contract meaningfully, given their high levels, history suggests to us that a US recession would be needed to crush profitability.

NOTE: This post is adapted from Citi North America Equity Strategy's "The November 2011 Chart of the Month," published on November 9, 2011.