Equity Strategy: March 2012 Chart of the Month

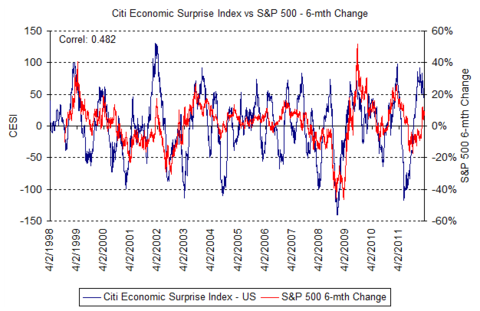

While economic data generally has been good, the mean reversion characteristic of the Citi Economic Surprise Index (CESI) from extreme highs or lows inherent in its construction can affect market perceptions about economic activity. The index is aptly named since it compares the reality of data relative to a set of expectations and, not surprisingly, equity markets react to any deviation from forecasts.

Citi's economists continue to project modest US GDP growth for 2012 and credit conditions support that outlook, but that will not mean that the CESI will not slide further if history is any guide. Moreover, with the S&P 500 up 24% from its lows, commensurate with the CESI beginning to rebound off of its lows, the downward shift in the index could signal some near-term market weakness.

However, underlying data does not indicate any serious economic problem recently and corporate capital spending intentions remain respectable. The "wealth effect" of a stronger equity market provides additional consumer capacity from the top 20% of income earners who account for as much as 50% of the nation's discretionary consumer expenditures. Yet, this will most likely not deter the CESI from mean reverting and causing some equity market volatility.