Equity Strategy: June 2012 Chart of the Month

With the focus on Europe, China and the latest nonfarm payrolls number, investors may be missing a major change in US housing. A recent report of disappointing US job growth has further deepened the investment community gloom even as credit conditions remain very positive for future domestic business activity. Moreover, there are positive dynamics brewing as well.

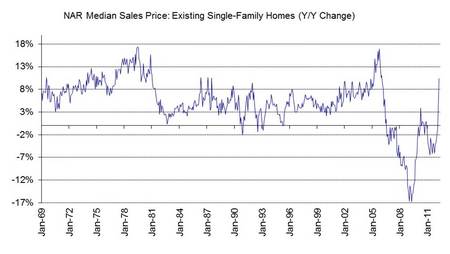

Median existing home sales prices have rebounded sharply. While distressed sales and short sales held down house prices in the past year or two and thus have allowed for easier comps, the price rebound has been startling and probably has been overlooked by many money managers who only hear about the poor economic data that can get sensationalized. Homebuilding activity also appears to have bottomed out and a recovery from very depressed levels is one of the additive GDP growth contributors to our US Raging Bull thesis initially outlined last December.

One should not expect this kind of price recovery to be sustained. The magnitude of the bounce in prices should not be extrapolated as a new booming trend, but there are signs of stabilization and even some improvement in various regions around the country. Hence, one should not dismiss this remarkable turn of events.