PERSPECTIVES

Equity Strategy: February 2013 Chart of the Month

February 13, 2013

- Investor sentiment tends to be the key difference for stock price movement. Various measures intimate that the investment community has become complacent in the face of the market's impressive gains thus far in 2013. Indeed, investors now seem to be more concerned about missing the upside than protecting the downside potential, as price dips are being perceived as new buying opportunities.

- Money flows indicate more bullish retail investors too. While S&P 500 futures contracts and hedge fund performance this year do not imply aggressive bullishness, the positive flows into US equity mutual funds suggest that individual investors are stepping in, chasing stocks. In addition, survey work contends that investors are becoming more upbeat.

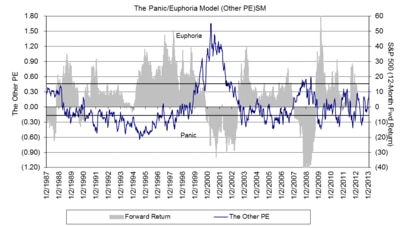

- The Panic/Euphoria Model has spiked to near its highs over the past three years, suggesting frothy levels have ensued. While a variety of other factors are constructive for equity indices, this proprietary gauge is starting to get perilously close to euphoria, cutting above the complacency readings seen in April/May 2012. In the past, when the model reached such levels, the equity markets experienced some modest consolidation.

Sign up to receive the latest news from Citi.

Select Preferences