By State, By Sector, By Size: A Look at Citi's Support of Small Business Through the Paycheck Protection Program

With the second round of the Small Business Administration's Paycheck Protection Program funding well underway, we are pleased to share data to date on where Citi's PPP loans are going – by state, by sector and by size.

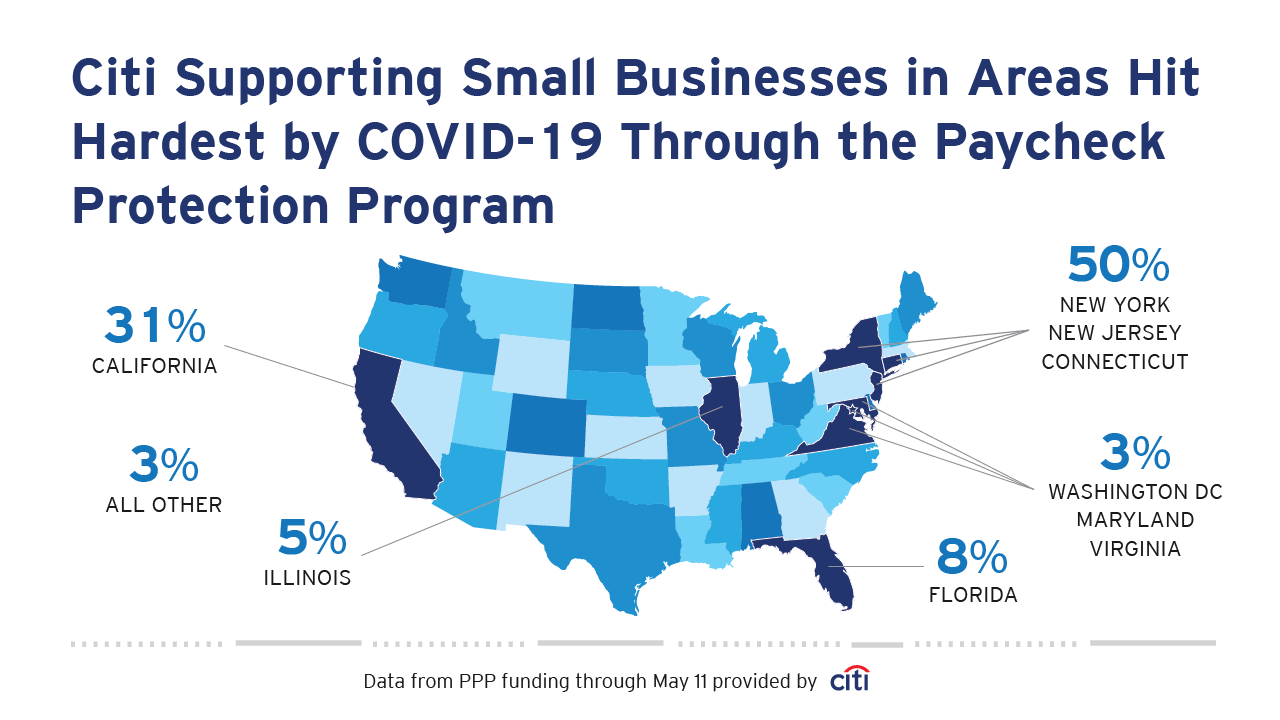

A recent Fed study indicated that the early data released by the SBA showed that the greatest number of PPP loans were not being made in areas hardest hit by COVID-19. As we've analyzed our own data coming in through the course of the program, we were pleased that the majority of Citi's PPP lending is reaching areas most impacted, with more than half of our loans going to the extremely hard-hit New York tri-state area, followed closely by California.

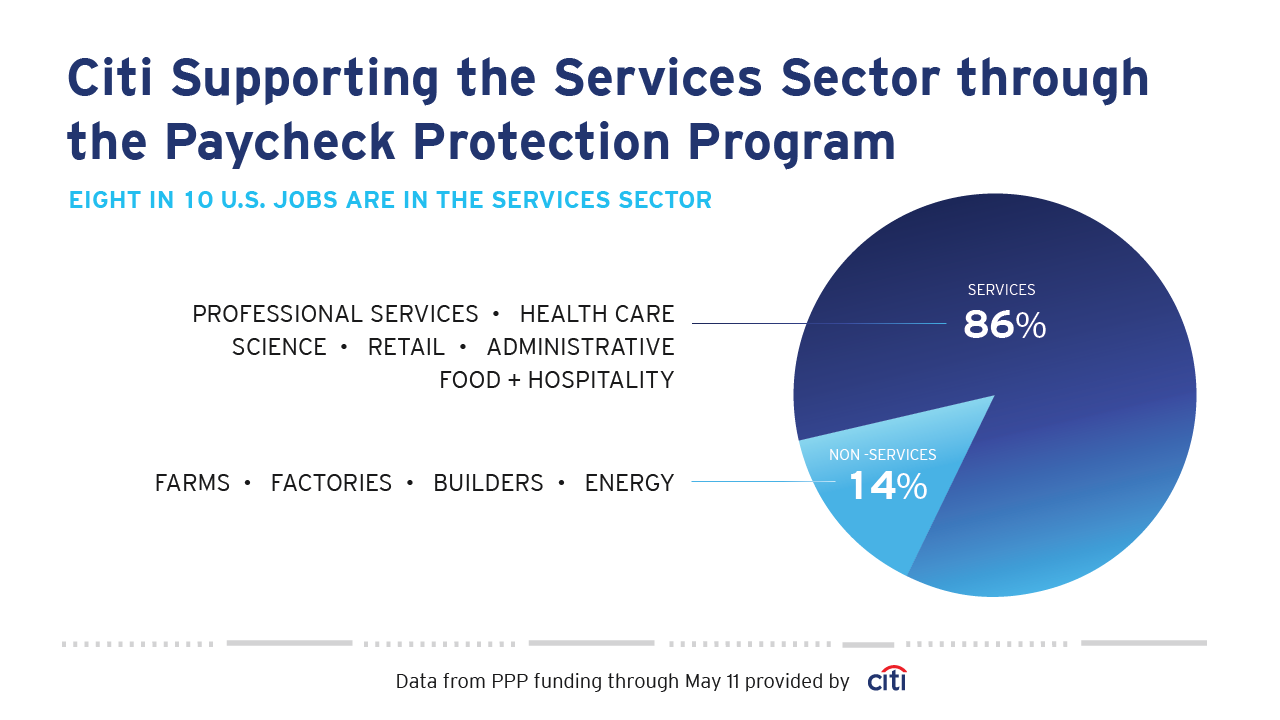

As we turn to sectors, analysis of our program data to date indicates that roughly 86% of Citi's PPP lending is being made to the services sector, which accounts for eight out of every 10 U.S. jobs. The services sector includes accounting and legal firms, doctor's offices, retail shops and restaurants and are critical to our recovery.

One of these small businesses is California Sanitary Supply, owned by Haewon Choi in Los Angeles. Ms. Choi opened a new small business checking account with Citi in April and within days submitted a PPP loan application that was promptly funded. "For a small company like mine, it's a big help," Ms. Choi wrote us. "I don't have to lay off my loyal employees who are already facing hard times during the pandemic and it also gave me peace of mind."

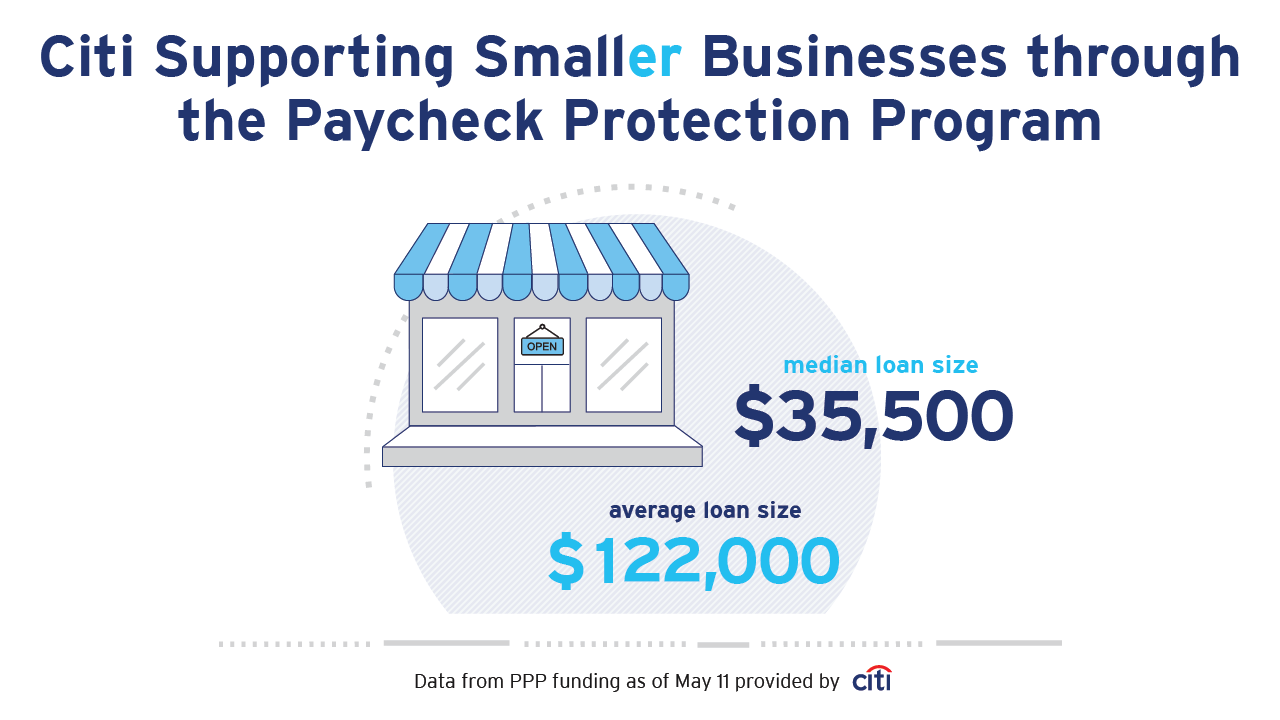

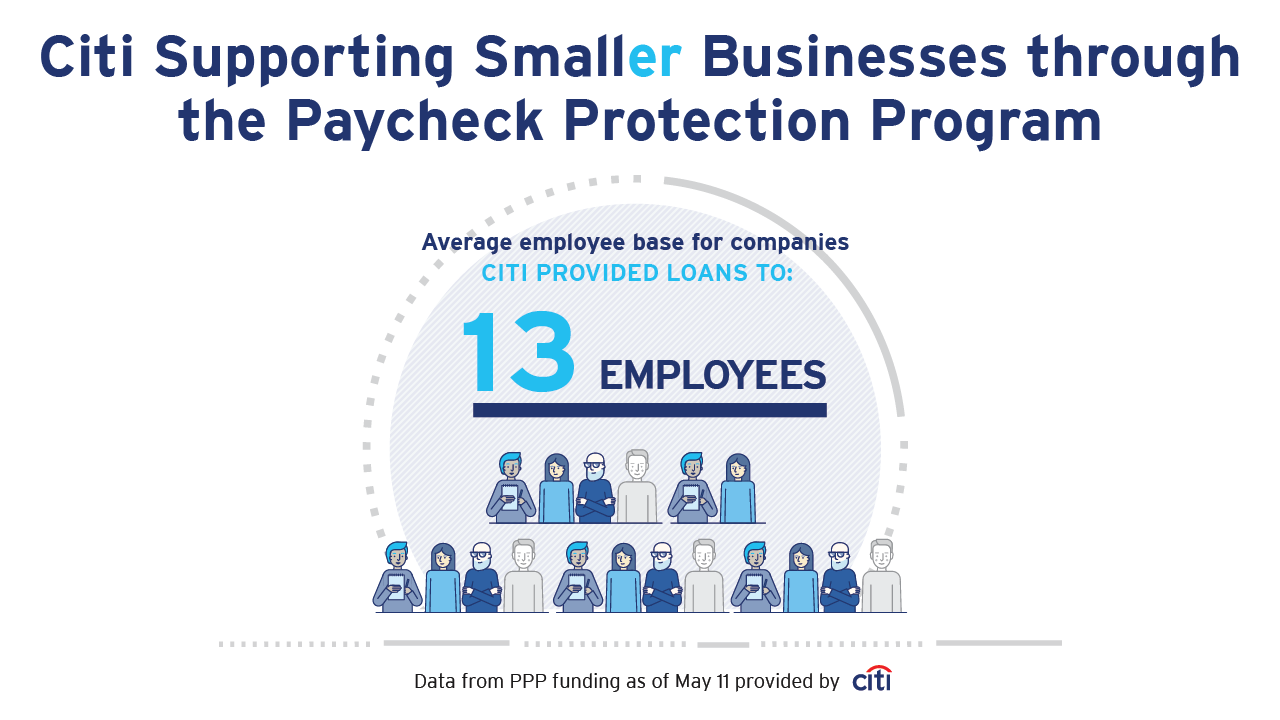

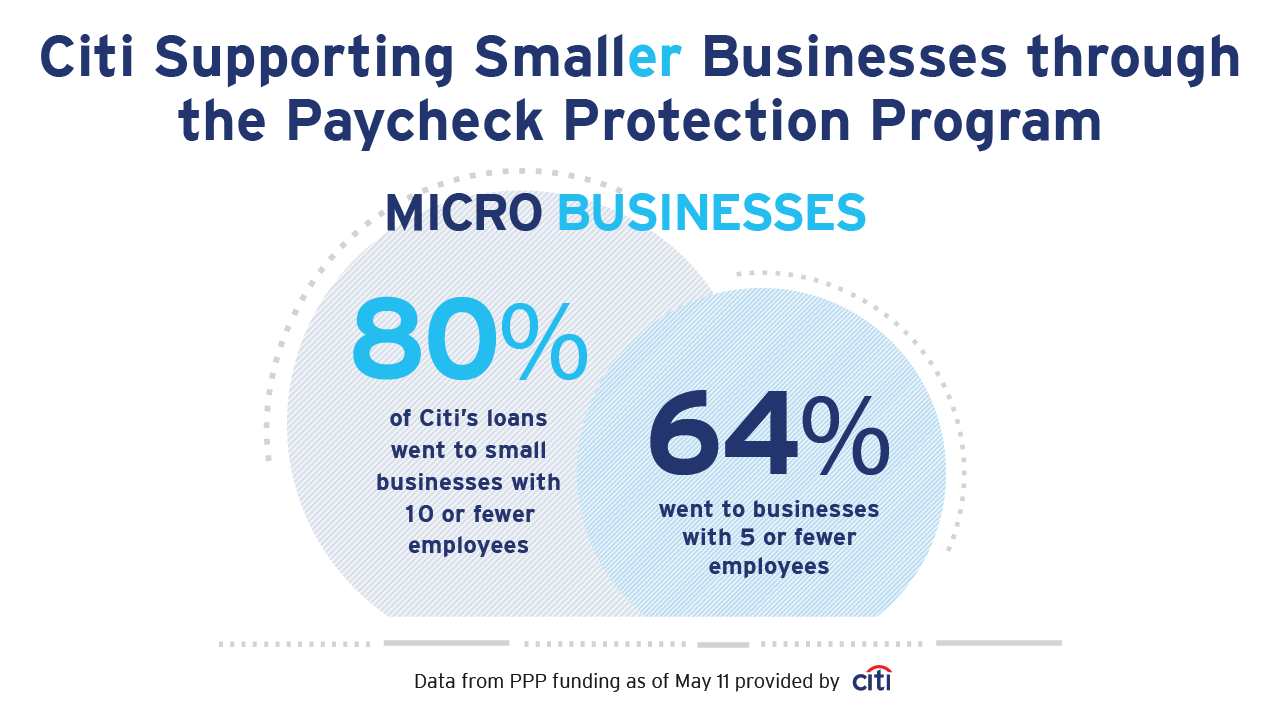

In terms of size, we proudly served the smallest of small businesses. To date, in two rounds of PPP lending, 80% of loans went to micro businesses, those with 10 or fewer employees, while 64% went to businesses with five or fewer employees. By contrast, approximately 1% of loans went to businesses with 100 or more employees. The average loan size was $122,000. The median loan size was $35,500.

We are proud to serve a breadth of small business sectors through PPP, including agriculture, manufacturing, construction, churches and nonprofits, to name a few, and to reach many of the areas most impacted. These businesses are the lifeblood of our neighborhoods, our communities and our economy and we are all #inthistogether.